This article was first published on NorskFisk.no on November 21, 2023

There is a huge untapped potential for cultivating seaweed, a resource with properties that make it suitable for a variety of commercially attractive purposes and address pressing global challenges. Seaweed cultivation can provide large volumes of biomass that are evidently needed and will be in demand in the coming decades. However, this won’t happen on its own, and several critical challenges need to be overcome. To highlight the issues and opportunities in seaweed cultivation, I sought support from Senior Advisor Jørn Pedersen at INAQ AS.

According to Seaweed for Europe‘s publication «Hidden Champion of the Sea,» it is an ambitious but realistic goal to increase seaweed cultivation in Europe from 300,000 tons in 2020 to 8,000,000 tons by 2030. The numbers are correct; from 0.3 to 8 million tons. Although 2030 might be too soon, these figures are achievable. However, this requires the development of technology that allows for large-scale production at much lower costs than today.

There are similarities between today’s seaweed industry and the salmon industry 50-60 years ago. Today’s salmon production would not have been possible without the technological advancements the industry has undergone. Seaweed cultivation today is characterized by a lot of manual labor, small units, and low profitability unless there is access to cheap labor.

Algae grow ten times faster than land plants, requiring less than a tenth of the area to produce the same amount of biomass.

Significant growth in the seaweed industry in Norway and elsewhere in the northern hemisphere will not happen without the development of technology that can elevate the industry to an industrial phase. This is entirely achievable and should be a challenge that attracts players with the necessary capacity and interest in participating in a development that can prove to be highly economically profitable while addressing important environmental challenges.

Tripled Market

The world’s population is expected to rise to 10 billion by 2050. Harnessing the potential of seaweed cultivation can make a significant contribution to feeding this population. Algae grow ten times faster than land plants, requiring less than a tenth of the area to produce the same amount of biomass. Seaweed does not compete with other crops on land, does not strain scarce freshwater resources, and is cultivated without the use of pesticides or antibiotics. This, combined with seaweed’s attractive properties, is part of the reason for the rapidly increasing interest in seaweed cultivation around the world.

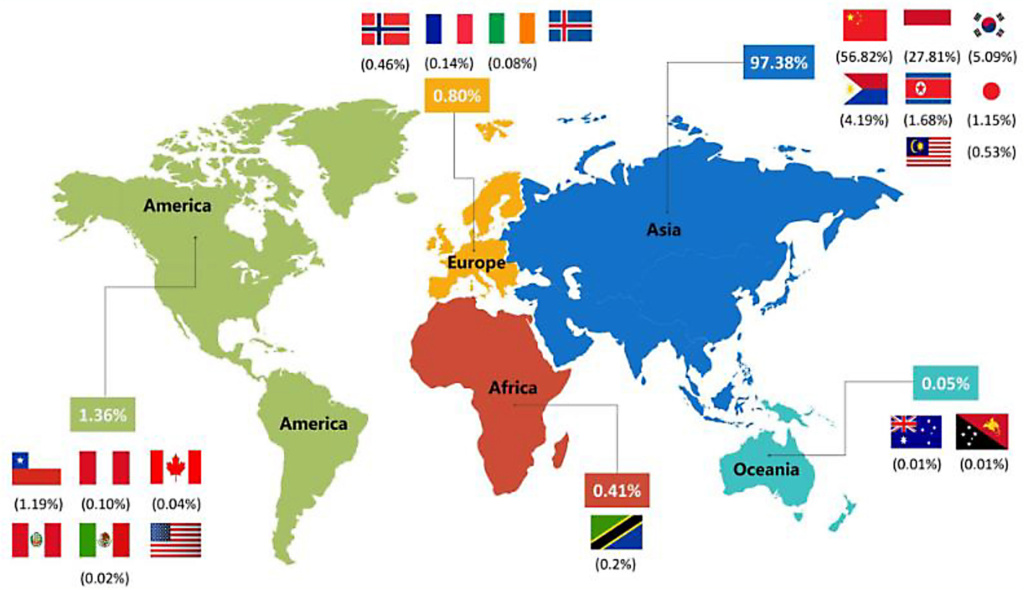

According to the FAO (Food and Agriculture Organization of the United Nations), the global market for seaweed more than tripled from 2000 to 2021, reaching 35.5 million tons wet weight valued at approximately 15.5 billion dollars. With today’s exchange rate, this is over 170 billion Norwegian kroner. About 97 percent of this volume was cultivated seaweed, with less than 1 million tons coming from harvesting wild stocks. Most of the seaweed—more than 97 percent—comes from Asia. See Figure 1. Production in Asia is now showing signs of decline. The background is complex, but it is noted that climate change is leading to shorter growing seasons and smaller yields, that many of the areas where seaweed is cultivated are at the edge of their biological carrying capacity, and that rising labor costs in these areas are making the activity less profitable than before.

Infinite Use Possibilities

Today, most cultivated seaweed is used for direct human consumption, as feed in aquaculture, or for the production of hydrocolloids, including alginate as a thickening agent. Seaweed cultivation mainly occurs in low-cost countries with simple means and minimal use of technology both in the primary stage and in further processing. There is thus a huge untapped potential to increase production, and many good reasons why it is important to succeed.

This is part of the backdrop for the investment of billions in research on new uses for seaweed and the emergence of numerous new companies with business models in this direction. There is significant public investment in seaweed, and in 2022, the EU launched its «Algae Initiative,» proposing 23 measures to kickstart the seaweed sector in Europe. The problem is that this is a sector that currently lacks a well-functioning value chain. In areas where the industry is developing, such as in Europe, the situation can be described as a «chicken and egg» problem. The startup and development of reception and production of seaweed are hindered by the very small volumes being cultivated, while investments in scaled-up primary production are hampered by uncertain market prospects.

There are numerous interesting applications for seaweed, including human food, feed ingredients, soil improvement agents, packaging, and bioenergy. Used as a feed ingredient in both agriculture and aquaculture, seaweed can reduce the use of soy, thereby contributing to greater sustainability. Research results also show that seaweed in cattle feed can improve animal health, reduce the need for antibiotics, and decrease methane emissions from the animals. Applications requiring large volumes, such as soil improvement, however, necessitate raw material prices that are not achievable with today’s production methods.

Seaweed Cultivation as a Climate Measure

Seaweed absorbs large amounts of CO2, a characteristic that can make seaweed cultivation interesting for achieving climate goals. One hypothesis is that cultivated seaweed, and thus large amounts of bound carbon, can be sunk into the ocean at great depths—depths where it will remain due to minimal mixing with surface water.

The research project «Seaweed Carbon Solutions» has a budget of 30 million dollars and will be conducted over three years. The project’s goal is to develop technology and potential business models for nature-based CDR (Carbon Dioxide Removal) solutions that are scalable and can be implemented over a long time horizon. This will be achieved by developing solutions for reducing greenhouse gases through industrialized offshore seaweed cultivation and conversion to climate-positive products or solutions. The project is led by SINTEF and is a «Joint Industry Project» (JIP) funded by SINTEF, DNV, Equinor, and Lundin Energy. The project shows that there is growing engagement among stakeholders who both have a vested interest in achieving results and the resources necessary to bring the industry to an industrial phase.

Seaweed absorbs large amounts of CO2, a characteristic that can make seaweed cultivation interesting for achieving climate goals.

Need for New Solutions

In recent years, most new company establishments and major investments in the sector have occurred in Europe and North America. The vast majority of these efforts have focused on developing new products, while a very small proportion has been aimed at developing technology to make cultivation more efficient. Without new technology in this area, it will not be possible to achieve production growth in areas where cost levels and thus the requirement for efficiency are higher than where most seaweed is currently cultivated.

However, this is not the only hurdle that must be overcome for seaweed cultivation to take off in the affluent parts of the world. There are also significant challenges related to regulatory issues and competition from other interests for marine areas. Additionally, there is a way to go before the quality and price level of the spores (seed) used reach a satisfactory level.

Regarding the competition for marine areas, the idea of placing seaweed farms in offshore wind parks is particularly interesting. Such co-location would provide better utilization of the areas occupied by offshore wind and the infrastructure established in connection with offshore wind farms. The Institute of Marine Research leads the OLAMUR project, which has received an EU grant of approximately 84 million Norwegian kroner and involves 25 partners from research, organizations, and industry. The project includes the establishment of three pilot sites for cultivating seaweed and mussels in existing wind farms off Helgoland and in the Kattegat.

INAQ AS has assisted a company developing technological solutions to streamline primary production, i.e., from the sowing of the seed to the harvesting of the seaweed. The Norwegian startup Blaaker AS assumes that significant growth in seaweed cultivation in the affluent part of the world will remain a distant dream without technology that allows for the cultivation of large volumes at much lower costs than is possible today. The ambition is to develop environmentally friendly technology that provides automated processes for planting and harvesting, and technology that makes offshore seaweed cultivation possible. Blaaker’s solutions could help unlock the rich opportunities for cultivating large amounts of seaweed that exist both in Norway, elsewhere in Europe, and North America.

Several Norwegian Players

Several companies are investing in the seaweed industry in Norway. Seaweed Solutions AS started in 2009 and was the first to cultivate seaweed in Norway. The company also produces spores and offers technical support to other seaweed farmers. Seaweed Solutions works systematically with research and development and earlier this year raised 46 million Norwegian kroner for its further ventures.

It is estimated by researchers that as much as 20 million tons could be cultivated in Norway by 2050.

If innovative companies succeed in finding new solutions and developing new technology, we will be one step closer to unlocking the potential of seaweed cultivation and the uses for the raw material. We are increasing in number worldwide while agricultural areas are both being depleted and reduced. More than 70 percent of the planet is ocean—a vast area with potential that can be far better utilized than we manage today.

In Norway, seaweed cultivation is a small activity but with great potential for growth. In 2020, 27 players produced a total of 336 tons worth 8.6 million Norwegian kroner. The industry in Norway, like elsewhere, operates with low-tech production, a lot of manual labor, and low volumes. There is also significant latent capacity in the industry as less than half of the licensed capacity is utilized. Researchers estimate that as much as 20 million tons could be cultivated in Norway by 2050.

Currently, the large figures mentioned concerning the seaweed industry are just a vision, but there are clear signs that governments, companies, and investors recognize the significant potential that exists. This is a good starting point for seaweed cultivation to become a new and important marine industry in our area.

ABOUT THE AUTHOR:

Frode Blakstad (65) is a partner and working chairman at INAQ AS in Trondheim. He graduated as a food technologist from Statens Næringsmiddeltekniske Skole in 1982, obtained a college degree in economics from Trondheim Økonomiske Høgskole in 1985, and completed a Master of Management at BI in Oslo in 2005. From 1984 to 1988, he worked at the Norwegian Technological Institute. He was then the managing director at Akva lnstituttet AS until 1996 and a partner at KPMG Consulting until 2000.

Since 2000, he has been a partner, CEO (2000-2018), and working chairman (2018-) at INAQ AS. Blakstad holds several board positions, including chairman of Sekkingstad AS, Trient AS, Torghatten Aqua AS, and Peter Hepsø Rederi AS, and board member at Bjørøya AS.

He has been a regular guest writer in Norsk Fiskerinæring since 2017.