This article was first published on NorskFisk.no on May 10, 2024

Demands and expectations for sustainability are sweeping through the seafood industry, setting high standards for effective navigation. The purpose of the sustainability directive is to transition towards more sustainable value creation. With expertise and ownership within management, sustainability work can become an essential part of a company’s strategic development. The value chain perspective provides new insights into the opportunities and challenges companies face. Sustainability work is also a critical arena for highlighting and strengthening the improvement of key parameters for the company’s valuation.

Here, we will share some of our best tips and experiences on how to extract added value from sustainability reporting, transitioning from talk and reporting to action. In other words, our tips for good sustainability management. To assist in creating this article, I sought support from senior advisor Erik Hognes at INAQ AS.

Even if a company is not subject to mandatory reporting, it still faces requirements from customers who must report throughout their value chain. This means no one can escape. The implementation of the EU’s sustainability reporting requirements signifies a shift from more or less voluntary reporting to absolute requirements for most actors in the value chain.

The European Commission is serious, introducing a broad set of requirements to force the industry towards more sustainable value creation. It is not only the EU market tightening the demands; similar requirements are being introduced in the USA. Therefore, competence and action on sustainability become necessary regardless of the market.

Photo: BERRE

Get Started!

Begin building your competence and a system for reporting as soon as possible. It will be costly and stressful to respond to sustainability reporting when your biggest customer or investors needed it yesterday. In a stressed situation, you cannot utilize the process for strategic development. At least six months should be allocated for inclusive, good, and constructive reporting. The EU’s sustainability directive includes more than 80 topics and over 800 data points. There is much to go through and many actors to involve.

It is essential to see the overarching goal: The requirements are there to force decision-makers to understand their impact and find the most effective measures.

Leaders who can use sustainability reporting as part of their overall strategy will be the winners. Today, much attention around sustainability focuses on how to master extensive and new reporting requirements. But amidst this, it is crucial to see the overarching goal: The requirements are there to force decision-makers to understand their impact and find the most effective measures. The EU’s sustainability directive is a transition directive — not a directive to document compliance with specific rules and regulations. Involvement and competence in the sustainability work of the board and top management are required.

Leaders must stay updated on what sustainability entails and what lies ahead. Sustainability is a concept that can encompass almost everything and is continually expanding. What is, for example, sustainable industry? Sustainability considers all three dimensions: environment, people, and economy. An important realization is that among the three, the environment (the planet) sets absolute limits. Exceeding them makes it impossible to maintain profitability and human rights.

A simple rule of thumb, which also reminds us that sustainability must include action, is that sustainability is about «doing good.» This includes not only «doing less harm» but also rectifying past damages. Those who still struggle to accept the responsibility imposed upstream and downstream in the value chain must be ready to handle the «nature crisis» and «regenerative measures.» When a company completes its value creation, the natural resources used should be in better condition than when it started. Regenerative agriculture is already established. Aquaculture and fishing must follow suit.

Knowledge is Opportunities

Expectations that a leader should understand and manage upstream and downstream impacts are demanding. Many may find it unreasonable to be held accountable for activities far beyond what they perceive as their reach. Many must work to reconcile themselves with such extensive demands. The Transparency Act is a good example of legally required oversight and responsibility in the global supply chains one is part of. Such expansions of the horizon are not just a challenge regarding systems and data, but also culture and attitudes.

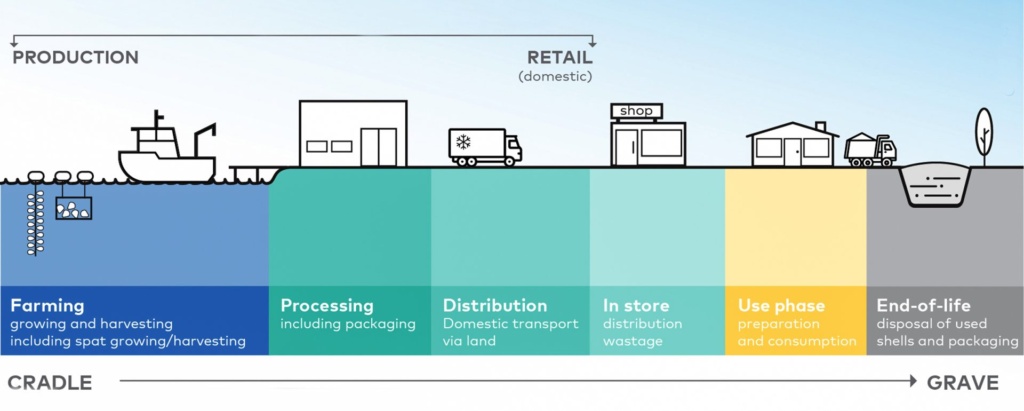

Mapping impacts in the value chain from cradle to grave is demanding, but used correctly, it gives management a broad repertoire of measures. For salmon producers, often more than 90 percent of the fish’s climate footprint lies in what we call «scope 3», which includes the purchase of products and services. It becomes impossible to significantly impact the salmon’s climate footprint without addressing it through the company’s suppliers. Feed accounts for the majority of the climate footprint, and the development of new and more environmentally friendly feed ingredients should be high on all fish farmers’ agendas. Circularity is another example where the value chain perspective must be in place to find the best and most important solutions.

Sustainability analyses and reporting are demanding in terms of costs for experts, as well as time and stress for one’s organization. Therefore, it is essential to extract added values from the process. Here, the process of mapping one’s value chain should be used as a diagnosis of one’s company. A heavy footprint can be an indication of inefficient operations.

With involved and engaged leadership participating in the preparation of the environmental accounts, the process will undoubtedly provide new and important perspectives on operations and insights into significant improvement opportunities. The most labor-intensive part is often data collection. Central data includes mass and energy balances. What goes in and out of your company in terms of materials and energy? This is also crucial knowledge for responsible financial management of the company.

A heavy footprint can be an indication of inefficient operations.

Foundation for the Positive

To report positive effects credibly, it is important to start with good control over your impacts. Here, methods such as Life Cycle Assessment (LCA) are recommended tools. An LCA accounts for the environmental footprint over the entire life cycle of a product — from cradle to grave, and the environmental performance is often measured on the consumer product. LCA allows producers to showcase the positive properties they can provide to their product during its usage phase. A good example of this is measures a seafood producer takes to reduce waste at retailers, for instance, by increasing shelf life.

Such effects are referred to today as «handprints» and «scope 4», and frameworks for reporting on positive effects are on the way. To understand and benefit from this regulation, you must first have built systems and competence on your analyses of your footprint. This will help you report the effects with greater credibility and accuracy.

When reporting and performance requirements become a prerequisite for market access, the value of the company’s sustainability work becomes concrete.

We recommend using sustainability reporting as an effective tool to highlight the company’s value. Aquaculture differs from some other industries in that key parameters for valuation are also very important for sustainability. Mortality, animal welfare, and feed factor are central to both financial valuation and sustainability. When used correctly, sustainability reporting can be a good arena for strengthening and highlighting strategy and improvement on key parameters for the company’s financial valuation.

When reporting and performance requirements become a prerequisite for market access, the value of the company’s sustainability work becomes concrete. Whether it also increases consumers’ willingness to pay or provides favorable terms from financing sources, however, is less clear. A number of actors offer so-called «sustainability rankings», but when comparing results from different ranking agencies, it seems they rank based on dice rolls. The whole concept of «ESG ranking» also loses trust when we see stories of carbon capture companies being pushed out of so-called «ESG indexes» in favor of an oil company.

Understand the Limitations

Environmental accounting is an important component of sustainability reporting. It is essential that management acquires a solid understanding of the methodology, data basis, and uncertainty associated with such accounts. This understanding is best achieved through active participation in the preparation of the organization’s own environmental account.

Climate accounting is the most established form of environmental accounting. Although a lot of regulations have been established for this, there are still significant gaps. Both the data basis and methodology are often inadequate and contain errors. This means that environmental accounts are characterized by significant uncertainty, and the results will change over time as both methodological requirements and data basis develop.

There is a tendency to focus solely on the results of the environmental account, but it is in the process itself that knowledge is generated. The EU Commission proposes introducing quantitative accounts for more than 16 different forms of environmental impact. The uncertainty resulting from methodological choices and data basis becomes significant and varies greatly from category to category. Understanding the strengths and weaknesses of the methodology is crucial when using knowledge from environmental accounts conducted by others, e.g., in green procurement or investment evaluations. Experience from one’s own environmental account becomes critical to uncover and avoid greenwashing.

Until recently, it seemed to be free rein for bold environmental claims. «Everyone» claims to be net zero or even in the negative. The EU Commission is taking a strong stand against this through its «green claims directive,» which among other things sets requirements for the basis of environmental claims. We already see examples of companies being reported and sued for environmental claims. While it is still important to highlight positive environmental aspects, it is now at least equally important to have competence and understanding of what is required to communicate this story and avoid falling into the greenwashing trap.

There is a tendency to focus solely on the results of the environmental account, but it is in the process itself that knowledge is generated.

Transparency

Transparency is the key word for credible and reliable sustainability communication. As a company leader, one must recognize that transparency will eventually become a requirement. It takes time to understand the level of detail that should be disclosed while balancing the desire not to reveal sensitive data.

Most companies need to bring in external expertise for parts of their sustainability work. If sustainability becomes a task handled primarily by external parties, it can be challenging to integrate sustainability as a constructive part of the company’s strategic development. Therefore, management must carefully consider the long-term costs of outsourcing all the work. It is recommended to do as much as possible in-house and primarily use external experts to build internal competence.

The fundamental principles of the EU’s sustainability reporting (CSRD) are that what is presented is material and relevant, that the information is credible – meaning well-documented and accurately described – and that the information is understandable and verifiable. To uphold these principles, it is crucial that management is involved and in agreement on what is reported.

Often, the first step towards good sustainability reporting will be a solid plan for improving internal data collection.

Today, there is a vast array of software providers promising to handle all aspects of sustainability reporting. However, none of them can perform miracles. If the company does not have a good understanding of its own inputs and products, no external software can solve this.

Often, the first step towards good sustainability reporting will be a solid plan for improving internal data collection. It is easy to get locked into external and expensive systems. If sustainability management is heavily based on comparisons over time, it can be challenging to switch platforms.

The question then becomes: Who can take responsibility for reconstructing several years of carbon accounting performed by another provider?

Summary

Sustainability remains an important parameter for business profitability and value. The EU’s sustainability directive is the locomotive pulling all actors in a value chain — big and small. No one gets a free pass. The requirements are extensive. It is crucial to start early. It takes time to become comfortable with the transparency and responsibility that the sustainability directive demands of leaders. Competence is also essential for making good choices of tools and services necessary for sustainability reporting.

The purpose of the sustainability directive is to transition to more sustainable value creation. With competence and ownership within the management, sustainability work can become a crucial part of the company’s strategic development. The value chain perspective provides new knowledge about the opportunities and challenges companies face. Sustainability work is also an important arena for highlighting and strengthening the improvement of key parameters for the valuation of companies.

Large parts of the Norwegian economy will be required to report on sustainability in the coming years. Extensive and new requirements mean that preparation must start today. Build internal competence, avoid stress, and use sustainability to increase the company’s value.

ABOUT THE AUTHOR:

Frode Blakstad (65) is a partner and working chairman at INAQ AS in Trondheim. He graduated as a food technologist from Statens Næringsmiddeltekniske Skole in 1982, obtained a college degree in economics from Trondheim Økonomiske Høgskole in 1985, and completed a Master of Management at BI in Oslo in 2005. From 1984 to 1988, he worked at the Norwegian Technological Institute. He was then the managing director at Akva lnstituttet AS until 1996 and a partner at KPMG Consulting until 2000.

Since 2000, he has been a partner, CEO (2000-2018), and working chairman (2018-) at INAQ AS. Blakstad holds several board positions, including chairman of Sekkingstad AS, Trient AS, Torghatten Aqua AS, and Peter Hepsø Rederi AS, and board member at Bjørøya AS.

He has been a regular guest writer in Norsk Fiskerinæring since 2017.